Best Credit Card UAE

Money Mall - One Stop for your all financial needs - Compare Bank Finance – Loans in #Dubai #UAE. Our goal is to educate consumers about the benefits and perils of credit cards UAE, Loans and Mortage. We believes that everyone should be able to achieve financial well-being and want to have an impact on our users’ lives, on financial product providers, and on the world of financial management in UAE.Our goal is to educate consumers about the benefits and perils of credit cards.

E-wallets are virtual wallets that stores payment card information on a mobile app. Its also known as Digital Wallets or Mobile Wallets, e-wallet service providers list their empanelled merchant stores in their app where you can make contactless in-store payments in a very convenient way via wallet app.

It’s the same as your credit card or debit card but it offers a host of other benefits. An E-wallet needs to be linked with your bank account or debit card to make payments.

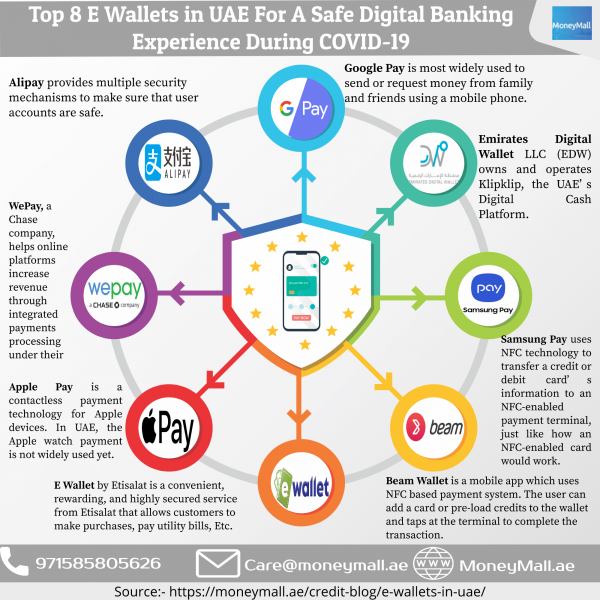

Here are some of the most popular E-wallets in UAE that will help you in going digital and contactless too.

1. Google Pay

2. Emirates Digital Wallet

3. Samsung Pay

4. Beam Wallet

5. E Wallet by Etisalat

6. Apple Pay

7. WePay

8. Alipay

What is the best strategy to control maxing out credit cards in UAE?

To some people, credit cards are a handy part of life and to others, a route to debt that can cause major problems. MoneyMall takes your enroute at how a credit card in UAE works and how you can control maxing out your credit cards.

How can you control maxing out credit cards in UAE?

Here are a few handy tips that you can follow if you have a credit card in UAE to control maxing out your credit card and have a high credit score UAE:

- Avoid the minimum payment trap. Rather pay as much as you can each month.

- Do not withdraw cash from your credit card as the bank charges on withdrawing cash are ridiculous.

- Work out exactly how much interest you are paying on your credit card. It might help you to think twice before making your next purchase.

- Freeze your credit card if you are an impulsive buyer and know that there is a sale coming up.

- Leave your credit card at home at times. Not having it with you reduces the temptation of using it.

- Always pay your credit card bills on time. You are penalized for late payments.

- Avoid creating recurring payments on your credit card.

- Double-check your statements to make sure that all the transactions were correct as well as to see where your money is going.

- Use the snowball effect to pay off your debt. Start with the smallest amount and once it is repaid, use the money you are saving to pay off the next smallest amount. This way you are building momentum in paying off your debt as well as creating small victories for yourself.

- Create a budget for yourself and stick to it. Make sure that you include money to save for expensive items.

What to do when you have maxed out your credit cards?

Even if you have the best credit cards in UAE, if they are maxed out, they can damage your financial situation for years to come. So, here are a few steps that you should follow if you have reached the limit on any or all of your credit cards:

- Set up a bare necessities budget that covers your rent or mortgage payment, your utilities, food expenses, and transportation costs.

- Cut out entertainment expenses and your clothing allowance for a short period of time.

- Find extra money or a second job to pay down your credit cards.

- Create a debt payment plan. For multiple credit cards with high balances, focus on reducing one balance at a time as this is more effective than trying to pay them down all at once.

- Opt for a credit counseling or debt settlement service if you are having a difficult time paying off your debt.

It's not that you can't make large purchases on your credit card. Using your credit card for large purchases allows you to accumulate rewards, meet the requirements for a sign-up bonus, or take advantage of a promotional interest rate. Of course, if you do not choose one of the best credit cards in UAE for yourself, there may be situations where even though your credit utilization ratio is low, your authorized limit is just not high enough to allow you to use your credit card for your desired purpose. In such cases, you can request that your card company increase your limit.

However, always make sure that you keep in mind that carrying a high credit card balance carries a number of risks from damage to your credit score UAE to less access to your credit limit. Increasing your monthly credit card payment will lower your credit card balance faster and prevent you from maxing out your credit cards.

10 Best Ways To Manage Credit Cards For Personal Gain In UAE

A credit card can be quite a valuable tool if it is used effectively but do you know easy and effective ways to manage your credit cards for your personal gain? Credit cards, if used, ineffectively, can lead to a world of harmful consequences. You may have the best credit card in UAE, but to use it well, it is essential that you follow a few simple steps. MoneyMall, brings you 10 easy tips and tricks to make credit cards in UAE work for your personal gain.

- Pay your credit card bill on time

Paying all of your bills on time is a great way to keep your interest rates low and improve your credit score. To avoid missing your due date, set a reminder on your phone a few days beforehand or mark the date on your calendar. You can also adjust your online account settings so your bill is paid automatically on a certain day of the month through a direct bank draft.

- Pay your bill in full every month

It’s often mistakenly believed that making the minimum payment on your card dues is sufficient. To avoid penalties, you must pay your bill on time. But to avoid heavy interest rates, you must also pay the bill in full. Don’t pay attention to the minimum dues, and make it a point to clear your full card balance every month.

- Take advantage of the rewards

Credit cards give you reward points for specific kinds of spending. Your accumulated points, thereby, can be redeemed for rewards in cash or kind. Use your card in a manner that helps you get the best out of the rewards and benefits you are eligible for.

- Keep your credit card details secured

Scammers keep finding new ways to defraud credit card users. As a basic measure, always keep security details such as security pin, CVV number, OTP, and expiry date private and secure. Be careful not to swipe your card in any place except POS machines and ATMs. An unsecured swipe could lead to your card being cloned and misused.

- Avoid using your card at an ATM

Credit cards also let you withdraw cash from ATMs. Avoid using this facility because even though they are allowed, ATM withdrawals attract heavy charges. You wouldn’t want to pay that, would you?

- Choose cards with extra perks

Even if you’re not interested in credit card rewards per se, you can still leverage the benefits of a credit card. For example, some of the best credit cards out there offer perks such as free travel insurance, primary and secondary rental-car coverage, price protection, and extended warranties. Some premium cards come with guaranteed gift vouchers and benefits, such as free access to airport lounges. Some gifts may also be provided as joining benefits, others as periodic benefits.

- Only use your card for the big purchases

Sometimes, the little $10 and $20 purchases can, over time, build up to a huge credit card debt when left unchecked. Consider using your card just for big purchases instead. The best way to do this is to save up for your purchase in cash first. Then, after you make the big purchase with your credit card (and reap the rewards points), you’ll have the funds to pay it off right away.

- Pay attention to the fee structure

Credit cards often have joining and renewal fees. However, there are cards that have no fee. When looking for a card, pay attention to the fee structure. The fee should be reasonable and should be outweighed by the card’s benefits. Moreover, many cards allow a fee reversal if you spend a certain amount annually. Look out for this reversal benefit to save on the annual fees.

- Avail a loan if required

Credit cards also allow unsecured personal loans based on your credit history. If you require financial help, don’t look for loans elsewhere. Use your credit card to avail of one.

- Know your limits

If you’re worried that you might overspend, ask your credit card company to lower your credit limit to something you know you can manage on a monthly basis. They should be more than happy to oblige since they ultimately want you to pay the money back, and they can often make the credit limit change effective immediately.

Credit cards in UAE are a necessity in many ways. They score over debit cards because of the reward points as well as the ease of conducting transactions even during a financial crunch. Therefore, it is always advisable to understand your card’s fee structure, rewards, interest rates, and penalties. Also, make sure that you do your research well and compare various cards to determine the best one for yourself and your lifestyle.

Source: https://dailygram.com/index.php/blog/699632/10-best-ways-to-manage-credit-cards-for-personal-gain-in-uae/

Cashback Credit Card vs Rewards Cards : Which One Triumph?

As the world is dealing with the coronavirus pandemic and our health and welfare are at top priorities, we have to be concerned about how Covid-19 is affecting your Credit Score and overall financial situation.

Plan now to ensure you are in the best financial place you can possibly be, we encourage you to be proactive in monitoring your credit card debt to stay on top of your personal finances.

A credit card is an essential tool, one that should be handled with extreme caution. You must know how to utilize your Credit during the COVID-19 outbreak to make the most out of your credit card and not get into trouble.

These are the 10 tips to manage your credit cards for good.

Find out about the relief measures your banks are offering!

Many banks across the UAE have offered several relief measures for customers during the lockdown. They have offered payment holiday periods, Discounted fees, and interest-free payments offers. Make sure you avail of these offers. MoneyMall has listed major relief measures offered by UAE Banks here :

Make a budget and plan ahead:

Start by setting a budget for yourself and stick to it. Chalk out a plan that contains your income, your regular expenses, and monthly payments that you have. Make sure you pursue the most efficient path for yourself.

Do not increase your credit line limit:

Increasing your credit limit on existing cards or getting a new line of credit during the lockdown will make you susceptible to falling into a mountain of debt. Make sure you reduce your expenses, not increase them.

Do not withdraw cash from Credit Card:

It is possible that you are facing a cash crunch, But Credit Card Cash withdrawal have to be the last option, It has very high-interest rates & fees.

Check for 0% EMI options:

buy Essentials from a Merchant who offers 0% EMI offer on your card, plan your budget and shopping according to match minimum transection amount requirement, Call your bank and covert the Transection in 0% Easy Payment Plans.

Transfer your balance to another bank :

Many banks in UAE are offering various benefits like 0% of Balance Transfer for new customer, if you have an outstanding and paying high monthly interest on an existing credit card then apply for a new credit card and have the outstanding balance converted to 0% or low-interest rates Installments. Checkout Best Credit Card in UAE on MoneyMall.

Check your credit score regularly:

Especially now, making sure your credit score and reports are accurate is critical. This way, you can be top of your credit and avail the Finance facilities when it's needed most.

Contact your Bank or Card providers:

If you don't think you can pay your credit card dues on time or you got stuck in a financial crisis, reach out to your bank or providers to see if they offer flexible payment options during this time.

Use mobile banking app:

Now is the best time to familiarize yourself with your credit card or bank’s mobile app. Bank and Card issuers are making sure more and more people use mobile banking. Make yourself useful to it. So, that social distancing is ensured.

Utilize Contactless Credit Card payments:

As we know COVID-19 spreads through touch, it’s the right time you start making the contactless payment only. Check for the wifi icon on your credit card, if you don’t have Contactless card, call your bank and have a replacement.

Do you think that moving into a new employer will affect your credit score? And that your credit score depends on your salary? Well, it’s time to have you in for a surprise. Here are 8 myths busted about credit score UAE that you thought were true.

Myth 1: A bad credit score lasts forever

Myth 2: Checking your credit hurts your score

Myth 3: Debit cards can build your credit score

Myth 4: Employer check your credit scores

Myth 5: Student loans don’t affect my credit score

Myth 6: A great credit score doesn’t really matter

Myth 7: Higher Salary means a higher credit score

Myth 8: You just have one credit score